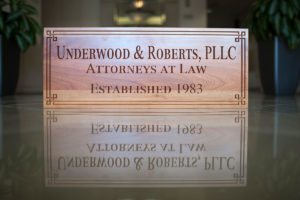

Underwood & Roberts, pllc - Employment Opportunities

No Positions Available at This Time.

No positions available at this time. Please check back in the future for opportunities.

(919) 664-8803

3110 Edwards Mill Road, Ste 300

Raleigh, NC 27612

Monday - Friday

9:00am - 5:00pm

(407) 354-3420

5728 Major Blvd., Ste 550

Orlando, FL 32819

Monday - Friday

9:00am - 5:00pm

(702) 699-7333

2400 S. Cimarron Road #140

Las Vegas, NV 89117

Monday - Friday

9:00am - 5:00pm